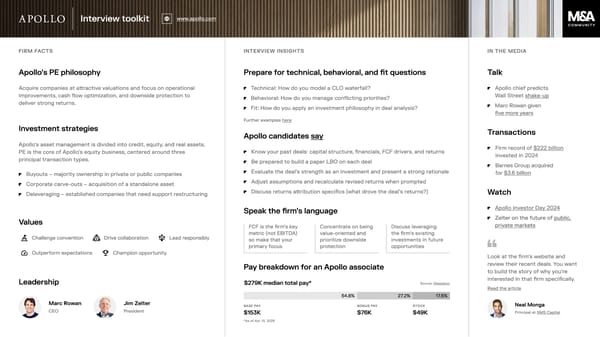

Apollo Interview Toolkit

Firm Facts Apollo’s PE philosophy Acquire companies at attractive valuations and focus on operational improvements, cash flow optimization, and downside protection to deliver strong returns. Investment strategies Apollo’s asset management is divided into credit, equity, and real assets. PE is the core of Apollo’s equity business, centered around three principal transaction types. Buyouts – majority ownership in private or public companies Corporate carve-outs – acquisition of a standalone asset Deleveraging – established companies that need support restructuring Values Challenge convention Drive collaboration Lead responsibly Outperform expectations Champion opportunity Leadership Marc Rowan CEO Jim Zelter President Interview Insights Prepare for technical, behavioral, and fit questions Technical: How do you model a CLO waterfall? Behavioral: How do you manage conflicting priorities? Fit: How do you apply an investment philosophy in deal analysis? Further examples here Apollo candidates say Know your past deals: capital structure, financials, FCF drivers, and returns Be prepared to build a paper LBO on each deal Evaluate the deal’s strength as an investment and present a strong rationale Adjust assumptions and recalculate revised returns when prompted Discuss returns attribution specifics (what drove the deal’s returns?) Speak the firm’s language FCF is the firm’s key metric (not EBITDA) so make that your primary focus Concentrate on being value-oriented and prioritize downside protection Discuss leveraging the firm’s existing investments in future opportunities In the Media Interview toolkit www.apollo.com Talk Apollo chief predicts Wall Street shake-up Marc Rowan given five more years Transactions Firm record of $222 billion invested in 2024 Barnes Group acquired for $3.6 billion Watch Apollo Investor Day 2024 Zelter on the future of public, private markets Look at the firm’s website and review their recent deals. You want to build the story of why you’re interested in that firm specifically. Read the article Neal Monga Principal at NMS Capital Pay breakdown for an Apollo associate Base pay Bonus pay Stock 54.8% 27.2% 17.5% $279K median total pay* $153K $76K $49K Source: Glassdoor *As of Apr 10, 2025