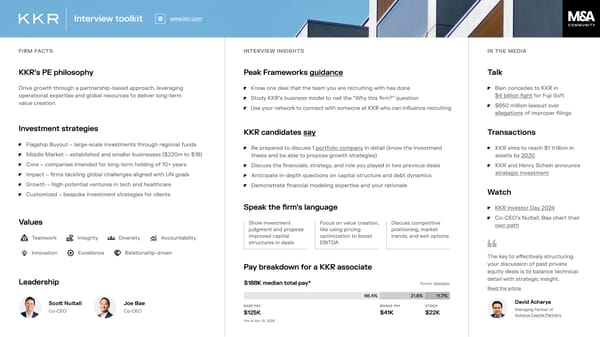

KKR Interview Toolkit

Firm Facts KKR’s PE philosophy Drive growth through a partnership-based approach, leveraging operational expertise and global resources to deliver long-term value creation. Investment strategies Flagship Buyout – large-scale investments through regional funds Middle Market – established and smaller businesses ($220m to $1B) Core – companies intended for long-term holding of 10+ years Impact – firms tackling global challenges aligned with UN goals Growth – high-potential ventures in tech and healthcare Customized – bespoke investment strategies for clients Values Teamwork Integrity Diversity Accountability Innovation Excellence Relationship-driven Leadership Scott Nuttall Co-CEO Joe Bae Co-CEO Interview Insights Peak Frameworks guidance Know one deal that the team you are recruiting with has done Study KKR’s business model to nail the “Why this firm?” question Use your network to connect with someone at KKR who can influence recruiting KKR candidates say Be prepared to discuss 1 portfolio company in detail (know the investment thesis and be able to propose growth strategies) Discuss the financials, strategy, and role you played in two previous deals Anticipate in-depth questions on capital structure and debt dynamics Demonstrate financial modeling expertise and your rationale Speak the firm’s language Show investment judgment and propose improved capital structures in deals Focus on value creation, like using pricing optimization to boost EBITDA Discuss competitive positioning, market trends, and exit options In the Media Interview toolkit www.kkr.com Talk Bain concedes to KKR in $4 billion fight for Fuji Soft $650 million lawsuit over allegations of improper filings Transactions KKR aims to reach $1 trillion in assets by 2030 KKR and Henry Schein announce strategic investment Watch KKR Investor Day 2024 Co-CEO’s Nuttall, Bae chart their own path The key to effectively structuring your discussion of past private equity deals is to balance technical detail with strategic insight. Read the article David Acharya Managing Partner of Acharya Capital Partners 66.4% 21.8% Base pay STOCK Bonus pay $188K median total pay* $125K $22K $41K Source: Glassdoor *As of Apr 10, 2025 Pay breakdown for a KKR associate 11.7%